Disney Buys Fox For $52.4 Billion: Here Are The Key Points Of The Deal

And it’s official: the Walt Disney Company said today that it has reached a definitive agreement to buy the majority of assets belonging to Rupert Murdoch’s 21st Century Fox. The all-stock deal is worth around $52.4 billion.

The deal has huge and far-reaching implications for the entire entertainment industry, creating uncertainty for many people. It will take a lot of time to untangle the effects of the deal.

The bottomline is that for consumers who desire choice and variety, this is obviously a very bad deal, reducing the number of major American-owned entertainment producers from five companies to four. It’s also nothing short of a travesty that a handful of profit-driven conglomerates exert so much control over America’s cultural identity, and that a relative handful of people control the narrative of a diverse and rich nation of 325 million people.

For an overview of what’s happening, read the official Disney press release that explains the deal, followed by this piece in the New York Times.

Here are some of the deal’s key points:

- Disney CEO Bob Iger isn’t leaving Disney in July 2019, as originally planned. His contract has been extended through the end of 2021. Rupert Murdoch, the executive chairman of 21st Century Fox, and Disney’s board of directors both asked Iger to stay.

- In terms of scale, the Fox acquisition dwarfs the previous ones that Iger made for Pixar, Marvel, and Lucasfilm. Disney shelled out just under $16 billion for those three companies combined.

- While the Fox deal is worth $52.4 billion, Disney is also taking on $13.7 billion of 21st Century Fox’s net debt, making the total transaction value worth $66.1 billion.

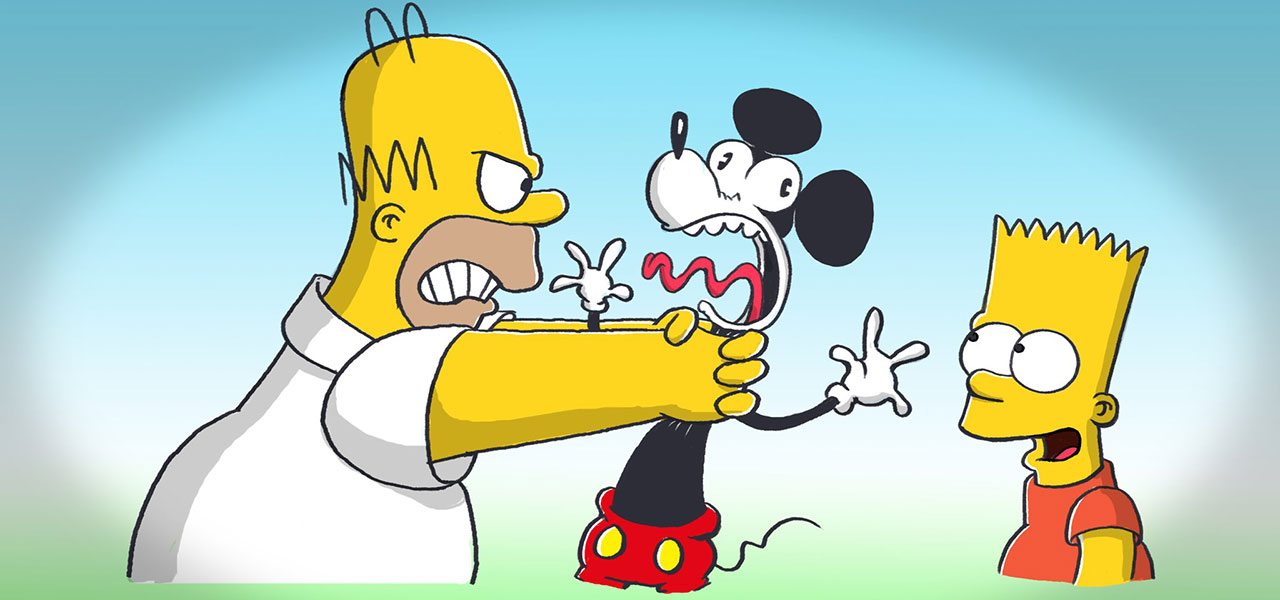

- Disney now owns the film rights to Avatar, X-Men, Fantastic Four, Deadpool, The Grand Budapest Hotel, Hidden Figures, Gone Girl, Planet of the Apes, Ice Age, The Shape of Water, and The Martian, as well as tv rights to This Is Us, Modern Family, The Simpsons, Family Guy, The Americans, and dozens of other shows. They also acquired FX Networks, National Geographic Partners, Fox Sports Regional Networks, Fox Networks Group International, Star India, and Fox’s interests in Hulu, Sky plc, Tata Sky, and Endemol Shine Group. The Simpsons team released the image below to commemorate being acquired by Disney.

- Specifically related to animation, Disney now owns Fox Animation and Blue Sky Studios. Is three feature animation studios too many or will Disney hang on to Blue Sky in addition to Disney and Pixar? Also important to note that Fox Animation was in a state of expansion, and recently signed a deal with the U.K.’s Locksmith Animation to create a second pipeline for animated films, in addition to Blue Sky. What’s going to happen to all these films? It’s a waiting game at this point. Blue Sky director Michael Thurmeier (Ice Age: Continental Drift, Ice Age: Collision Course) reflected on the confused and uncertain mood at Blue Sky with the tweet below.

- Expect layoffs – and “substantial” ones according to analysts quoted by the LA Times. Disney has already said that the acquisition is expected to yield at least $2 billion in cost savings from “efficiencies realized through the combination of businesses.”

- Disney did not acquire Fox Broadcasting network and stations, Fox News Channel, Fox Business Network, FS1, FS2, and the Big Ten Network. 21st Century Fox will separate those assets into a newly listed company that will be spun off to its shareholders.

- Disney, which previously owned 30% of the streaming service Hulu also bought Fox’s 30% share, giving them a majority stake in the service. The other owners include Comcast and Time Warner.

- Disney is now a serious player in online video. “We are not really looking to necessarily reach the scale of Netflix quickly,” Iger said this morning on Good Morning America which airs on Disney-owned ABC, “but we certainly aim to be an able competitor to theirs.” Disney has already announced that they will launch multiple streaming services in 2019.

- Disney’s international reach significantly expands with the acquisition of Sky, Fox Networks International, and Star. Sky serves nearly 23 million households in the U.K., Ireland, Germany, Austria, and Italy; Fox Networks International has more than 350 channels in 170 countries; and Star India operates 69 channels reaching 720 million viewers a month across India and more than 100 other countries.

- The deal still has to pass U.S. regulatory hurdles, which as Variety points out, will be a complicated process.

- Rupert Murdoch’s son, Fox chief executive officer James Murdoch, could play a key role at Disney and a Bloomberg report has even speculated that he could succeed Iger at Disney in 2021. For now, all Iger is saying is that, “James and I will be talking over the next number of months. He’s going to be integral to the integration process, and he and I will be discussing whether there is a role for him or not at our company.”

— Matt Selman (@mattselman) December 14, 2017

So many complicated feelings today. pic.twitter.com/VPhj5y9Bl5

— Michael Thurmeier (@mthurmeier) December 14, 2017

.png)