Anime’s Global Takeover: One In Three Consumers Watch Weekly, 150 Million Netflix Subscribers Are Tuning In

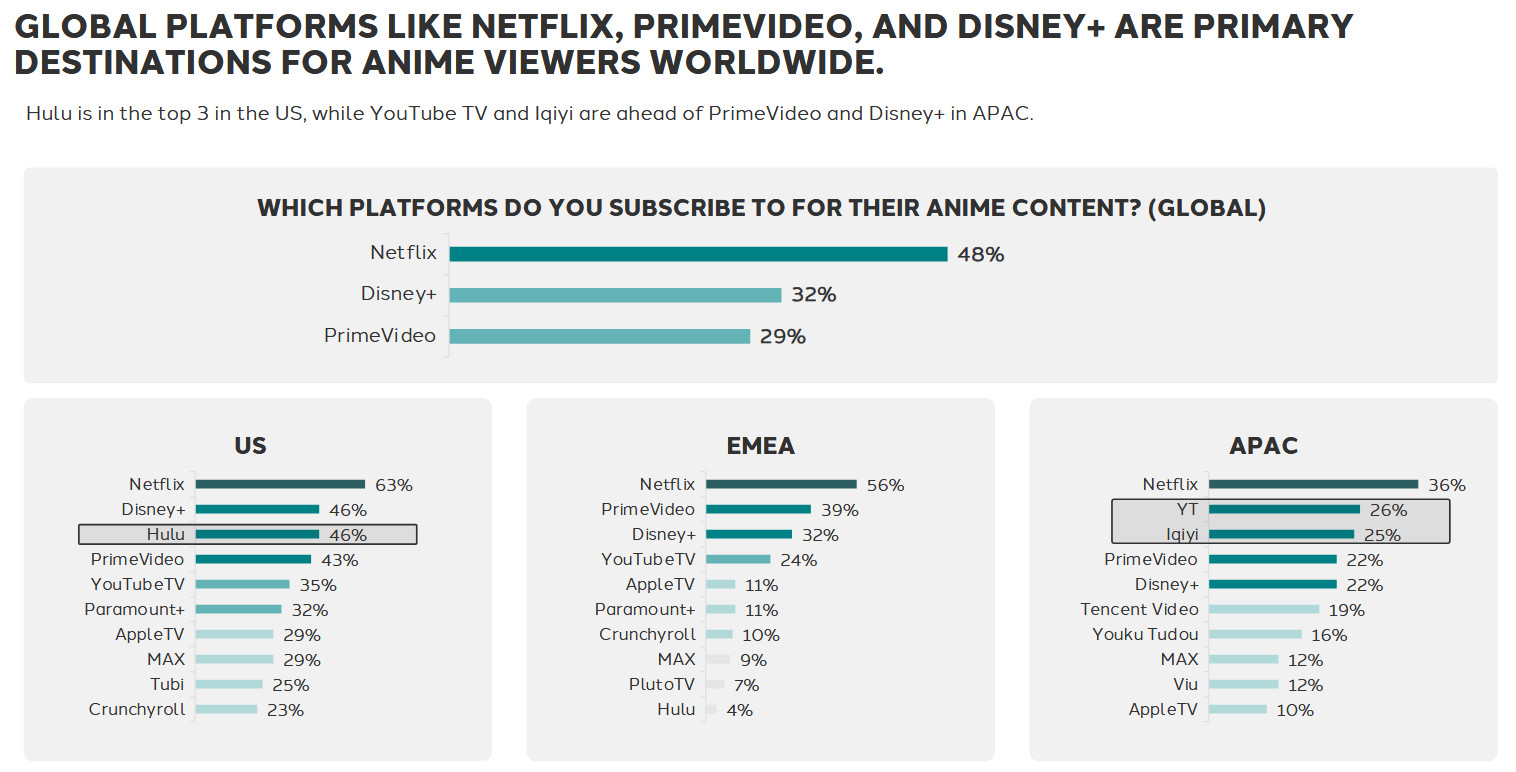

In its Anime Expo wrap-up, Netflix revealed that half of its 300 million global users now watch anime. That figure aligns with a recent Dentsu study, which found that 48% of global anime viewers subscribe to Netflix to do so, putting the streamer far ahead of competitors like Disney+ (32%) and Prime Video (29%).

According to Dentsu’s 2025 Global Research Report, shared first by Variety, anime is no longer on the entertainment periphery; it’s a global mainstream phenomenon. The study, which surveyed 8,600 consumers across ten countries, including the U.S., Japan, the U.K., and China, reveals powerful insights into the rise of anime viewership, generational shifts, fandom engagement, and commercial opportunities for brands.

Anime’s Global Rise: From Niche to Mainstream

Dentsu’s data reveals that 31% of global consumers watch anime at least once a week. The Asia-Pacific region leads in consumption, with countries like Thailand, Indonesia, and Japan showing the highest weekly viewership rates (over 50%). However, even in Western markets such as the U.S. and the U.K., anime viewership is experiencing a surge. One in three U.S. consumers watches anime weekly, proving that the genre has moved beyond its cult following into broader pop culture relevance.

This growth is especially pronounced among younger generations. A striking 50% of Gen Z and 48% of Millennials watch anime weekly. In contrast, Gen X and Boomers engage far less frequently, highlighting anime’s firm foothold in youth culture.

Why the World Is Turning to Anime

What’s driving this global fascination? According to Dentsu, it’s not just the animation style; it’s the storytelling depth, emotional nuance, and cultural diversity that anime delivers. Viewers cite the genre’s “unique worlds and stories” and “variety of genres” as top draws. In the U.S., 3 in 10 viewers say they’re turning to anime due to fatigue with repetitive Hollywood franchises, a sentiment not as widely echoed elsewhere.

Anime’s appeal also stems from its ability to cater to adult audiences, a contrast to the often family-focused perception of Western animation. Millennials and particularly men cited interest in Japanese culture and anime’s mature themes as motivators for their fandom.

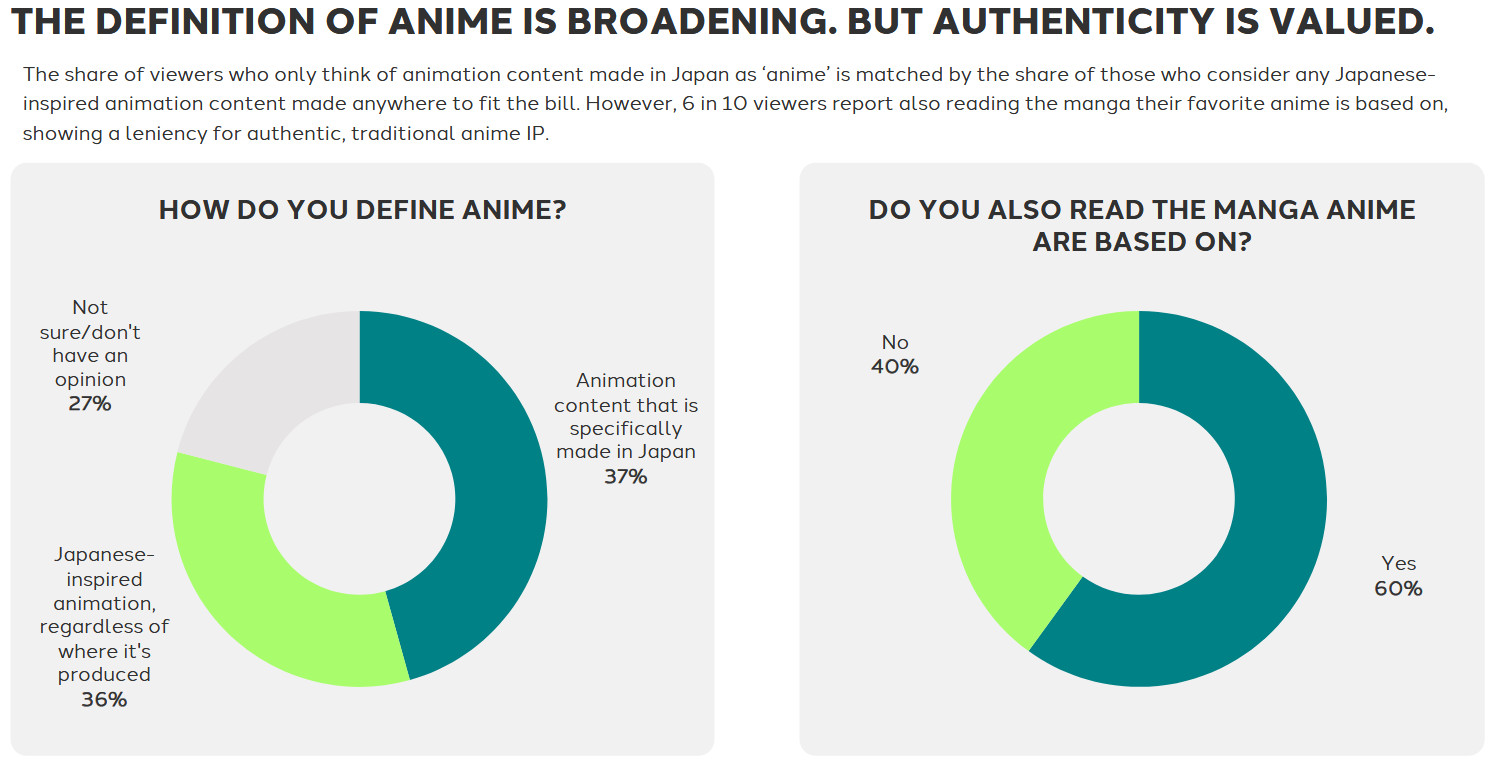

Interestingly, the perceived definition of anime is also evolving. While 37% of global viewers believe anime must be produced in Japan, an almost equal share (36%) accepts Japanese-inspired animation from anywhere as authentic. (Cartoon Brew still falls firmly in the former category)

Still, authenticity remains critical: 60% of anime viewers read the original manga, and many expect involvement from original creators in adaptations, especially live-action projects.

U.S. Viewers Are Passionate and Profitable

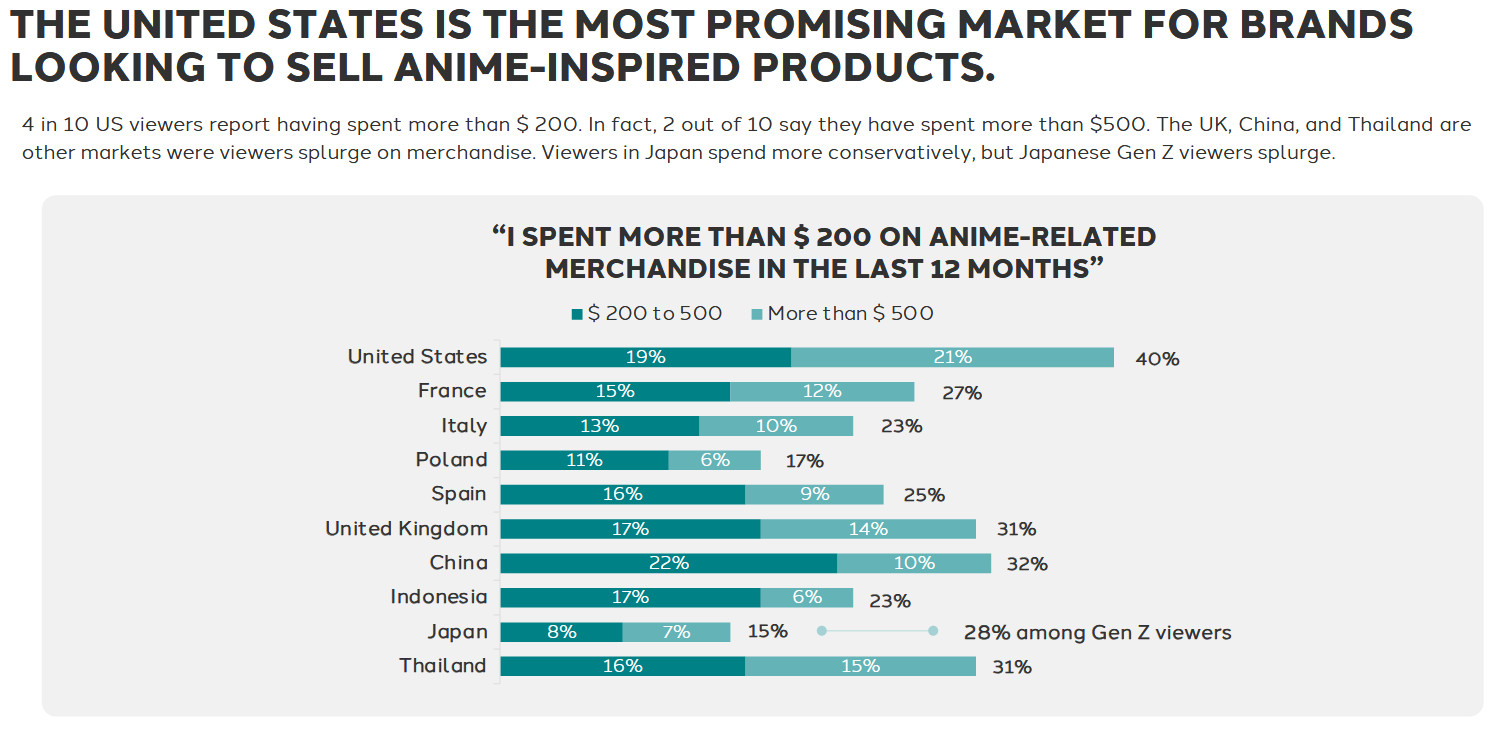

U.S. anime fans aren’t just watching, they’re spending. An eye-popping 40% of American viewers reported spending over $200 on anime merchandise in the past year, and 20% spent more than $500. That makes the U.S. the most lucrative market for anime-related products globally, followed by Thailand and China.

This high engagement goes beyond purchases. American fans are also among the most active creators in the fandom. Nearly 10% of U.S. viewers host their own anime podcasts or livestreams, and 11% sell anime-inspired merchandise on online marketplaces. These “mega-fans” reflect a participatory culture where fandom becomes content creation, turning passion into profit.

Streaming Drives Discovery, Influencers Fuel Engagement

Streaming platforms play a major role in anime’s accessibility and growth. Netflix leads globally, followed by Disney+ and Prime Video. In the U.S., Crunchyroll and Hulu are major players, with Crunchyroll emerging as the go-to for hardcore fans seeking depth and breadth in anime titles.

Meanwhile, younger viewers are increasingly engaging with anime through content creators. Around 30% watch anime-related podcasts and livestreams, and 34% read in-depth reviews. Platforms like Discord, Reddit, and anime conventions are also integral for community building, particularly for Gen Z, who are most active across these spaces.

Authenticity Is Everything

Anime’s popularity presents a huge opportunity for marketers, but the approach must be nuanced. Dentsu emphasizes that anime is not monolithic: viewer motivations vary by age, gender, and geography. A one-size-fits-all strategy won’t resonate.

Cultural fit and authenticity are key, then, argues the study. Brands that incorporate anime IP must be thoughtful. Consumers prefer when anime content or collaborations feel true to the original vision, especially when it comes to adaptations. Gen Z and Millennial consumers, in particular, reward this integrity. Over 40% of anime viewers say their opinion of a brand improves when it incorporates anime-inspired designs or promotions, and that number jumps to nearly 60% in the U.S.

Anime Rules

Anime has officially transcended borders, language, and generations. Its rise in the U.S. and around the world signals a shift in global media consumption, one that values storytelling, cultural depth, and emotional resonance. For fans, anime is more than just entertainment; it reaches into every aspect of their lives. For brands, it’s an opportunity, but only if they’re willing to engage the fandom on its own terms.

Pictured at top: Lupin The Third: Castle Cagliostro

.png)